Did they put a list up of the 50? Or have you got one and it’s updated and so must have been in it?

Edit: I remember someone confirmed the same in a post

Did they put a list up of the 50? Or have you got one and it’s updated and so must have been in it?

Edit: I remember someone confirmed the same in a post

I do have a Monzo card in fact I am a Beta User. The message coming through from the tweets is the ‘instantness’ of everything and the blog of things to come. The CS might be great but why do so many people need to access it?

This isn’t the right topic to discuss the rest of Monzo’s benefits I’m afraid. This would probably be the one to ask this sort of thing in -

The quick answer to this though is: because Monzo has a lot of users. I’m not sure we can tell whether Monzo gets more queries per user than other provider’s. Although looking at other provider’s (I can’t say who I’m referring to because of my job) mentions on Twitter is quite interesting ![]()

I was surprised because for the brief time I was with bulb you couldn’t have a DD, they did card charges.

You commented on the usefulness of the tools originally. You quipped back to another contributor that he already knew the advantages. I asked what those advantages are - you direct me to tweets and a blog. An analysis by myself is then posted for your comment and then as the argument goes against you, you then pull the usual ‘this isn’t the right thread’.

Never mind I’ll continue as I have been all these years and if I see an advantage in the Monzo CA I’ll start using it. The O/D fee certainly won’t be an upside if things don’t change.

As I said it’ll take too long to explain why Monzo’s features will make people want to use the overdrafts - for a lot of them, it’s the same reasons people use Monzo in general.

But I’ll meet you in the middle - here’s the features & functionality that directly benefit someone who chooses to use Monzo’s overdrafts:

if you’re not sure how they’re linked, you can try the feature out or read more about it in the blog

This thread has gone on for too long and seems to get quite personal at times. To try and take the bore out of it and come to a conclusion. Let’s just focus on the points raised and peoples general feel for it.

First and foremost. Monzo Overdrafts are middle ground - they are not cheap but they are not the worse out there.

There will be banks cheaper than this, however a lot of those banks have so many other charges that any savings in overdraft fees are nothing compared to money made in other fees.

Let’s use Natwest as an example,

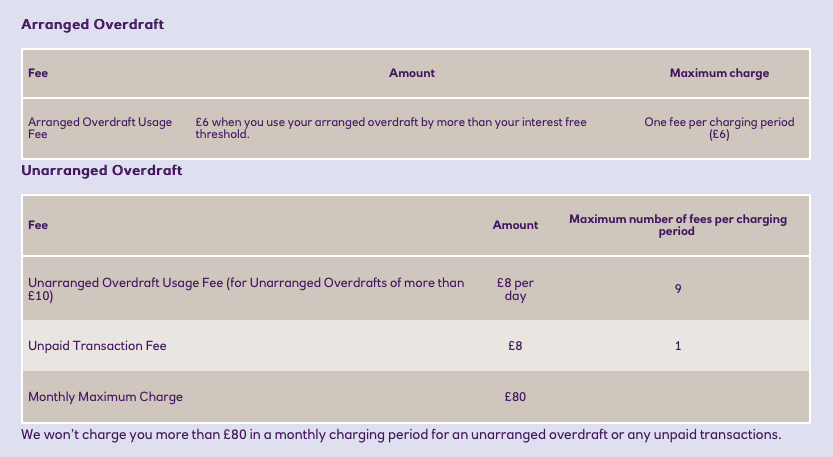

If I use my overdraft, regardless of how much. There is a £6 fee.

If I dont have an overdraft, or use beyond that, I get charged £8 a day.

Now, if I have other issues, let’s look at this charging fee:

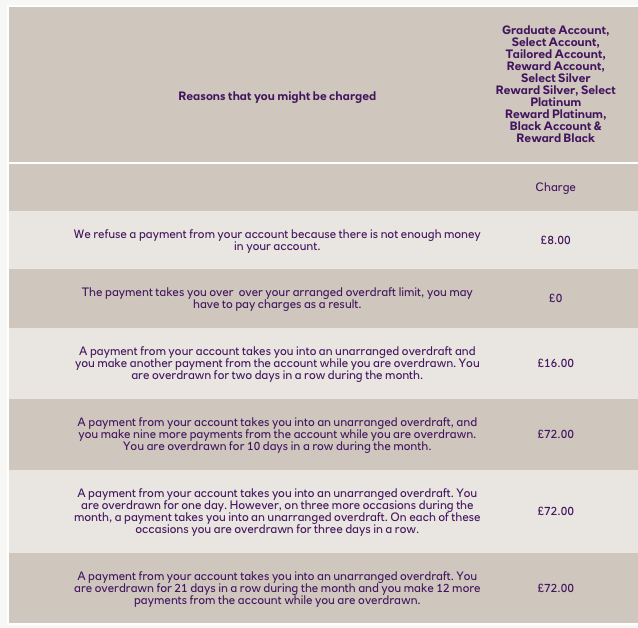

£8 to refuse a payment, £72 if I’m overdrawn over 21 days.

Monzo doesnt have any of those stupid fees, they will bounce a payment for free. They will not take me into an unarranged overdraft.

That’s where the value of Monzo comes in, you save so much elsewhere that it be ridiculous to think Monzo will have the cheapest overdraft - otherwise Monzo would never be able to fund a current account (I remember Tom saying it costs around £20 a year to host someone’s current account).

Now I know this can go on forever, and people can bring up other banks examples. The problem is, a bank account has so many features and charges in different areas, you can always find one that has something better in one area, but it’s worse in another area. Fundamentally though, every bank has to cover it’s cost somehow - its all about giving the appearance in some areas its cheaper to make people switch and get charged in other areas.

The wildcard here is Starling which I know is more competitive in price and doesn’t have all the fees the traditional banks. Let’s be clear - Starling have been very open they don’t intend to make money till middle term. So right now, they can offer unlimited ATM usage abroad, the cheapest overdrafts out there etc because it’s the current “fish” to get people in and build the brand.

The most Money savvy people if they want to save money can go to Starling and enjoy the cheapest overdraft and no fees for things and I urge them to. That bubble will burst but it’s worth enjoying it while they can. But it does become boring using them as a comparison when we all know that it IS going to burst once they actually get a lot of customers and the current fee structure will change and be a shock to a lot of people.

It just seems that Monzo is ahead of the curve as they already have way more users than Starling so are having to enter the ‘we need to make a profit to stay alive’ mindset a lot sooner. In turn, for those who dont mind changing current accounts all the time, it’s a good bet to milk Starling while you can. But we’ll be here in a years time actually comparing like for like then we’ll have a better idea who’s better.

Any chance we can all move on to more pressing things now?

Today I took money out from a cash machine that adds a £1.75 fee onto your withdrawal, that’s 3.5 days worth of Monzo overdraft thrown away by me in a transaction that took less than a minute. I did it for the convenience of having money that I really needed in that moment. I try to use the card at POS as much as I can and, when cash is needed, I rather withdraw from a cash machine with no fees. Occasionally we just have to spend some extra cash for that immediacy and convenience.

I intend to use the Monzo overdraft in exactly the same way. Sure there is cheaper credit out there but a few £ here and there, the odd month just to get me to pay day… ¯\_(ツ)_/¯

Sorry where was this? I missed that… I’ve seen this tho…

I’d put end of 2019 which is almost 2 years away as Middle Term. Let’s compare the charges around that time and it will make some interesting discussions.

I think you just missed the whole point of the post (or didnt read it) to try and find a quick easy come back. The £6 charge by the way is a charge ONTOP of whatever APR they use and once you hit 21 days the charge becomes insane…

You can spend hours of your life going on and running different Scenarios.

If I borrow X amount for X days with X Bank I will be charged Y.

Now run all those variables and I’m sure it be great reading for the most keen of money saving fans with nothing better on their hands.

The point was clearly, every bank charges fees, every bank aims different areas at different costs. Each bank will beat others banks in certain aspects. The point I was clearly making is if people stopped looking at just the Overdraft Fees and instead the Overall Banking Fees (Overdrafts, Unarranged, Foreign Transactions, Inbounds, etc etc etc) you’ll suddenly realise the proposition Monzo is offering is still one of the cheapest out there (except of course that one Bank who’s still in a very early growth stage I mentioned specifically).

Instead the Overdraft Fee which is one small part is being constantly compared to make out Monzo is an overcharging bank - it’s just a bore now.

Finally, as an ex-Natwest customer fully on the Monzo right now, even with the full overdraft I have (£1000) I’m getting a bargain of a current account and love it.

I do have one question I am hoping Monzo can answer. In the scenario where you have used the full limit (say £100) and then get the full fee (£15.50) you are sitting at over your limit

-£115.50 and you don’t put any money in the following month -£131.

How do Monzo plan to hand this scenario?

the charges you are refering to in your earlier post in this thread are for “unarranged” overdrafts, charges for arranged overdrafts are much less.

Monzo overdrafts are arranged overdrafts so you are not comparing like for like.

Ahh Mr Starling has arrived

If you fancy the time, can you run the scenarios for every eventually for every bank?

Because it seems all anyone does is try and find a scenario where the overdraft doesnt beat another bank and ignores the bigger point now put twice.

Of course, not withstanding the other bank mentioned for obvious reasons already put.

Excellent news, any other points to try and nit pick or can we just move on and accept the bigger point made?

Well, if someone just dips into it, its cheaper than others who charge an upfront fee if its just a day but let’s agree not to be petty to each other and run scenarios where its cheaper vs more expensive in the interest of letting this thread have some peace.

We can all agree - Monzo Overdrafts (and JUST Overdrafts), are not the cheapest out there.

Let’s hope Monzo can keep other services free/cheaper to make an overall “Product” of a current account good value.

I am not attacking your argument just pointing out for the benefit of others that the example given (even if unintentional rather than intentional) is misleading in comparing unarranged overdraft charges at a competitor bank with arranged overdraft charges at Monzo.

As for referring to me as Mr Starling (disregarding that in breach of the community T&Cs) I have relationships with 8 different banks and am a shareholder at Monzo. I am not biased towards any bank, Monzo or Starling, and endeavour to always have a reasoned approach unlike some users who are blindly devoted to Monzo and never prepared to consider constructive feedback.

The Mr Starling comment was meant in light humour (hence the wink) as I always see your face when I’m on their community forum  (I’m also a heavy user of others to).

(I’m also a heavy user of others to).

If it did offend, I’m more than happy to remove (as its intent was more fun than anything). This thread needs some fun and less hostility.

One could argue that it is worth comparing because one wont ever give you unauthorised overdraft charges and one will quite happily. but then someone can come back with ‘you can put control on it’ and all hell will break lose (again :D)

Thanks…missed the wink…reading on my small phone screen in the rain not on a nice big PC  no offence taken

no offence taken

We would reach out to the customer offering our support and when the customer might expect to get back out of their overdraft. We would sort out a promise of payment and work with the customer.

We know people use their overdrafts for many different reasons and we would want to understand how we can help you to manage your money.

If you want more information or specific questions answered I can get in touch with our specialists.

Excellent answer and what I was expecting. Thank you