If you have already paid into an ISA this tax year you’ll need to wait until next week is you want to open a new one and pay money into it.

I don’t know about transfers, that’s not clear to me at the moment.

If you have already paid into an ISA this tax year you’ll need to wait until next week is you want to open a new one and pay money into it.

I don’t know about transfers, that’s not clear to me at the moment.

So I keep the existing one and that runs alongside this new one when the new tax year starts?

If you have already opened and paid into a CASH ISA this tax you can’t open and pay into a new one.

You can open the Monzo one in two days time (I think?) and start paying into that one, but you can’t pay into your other one.

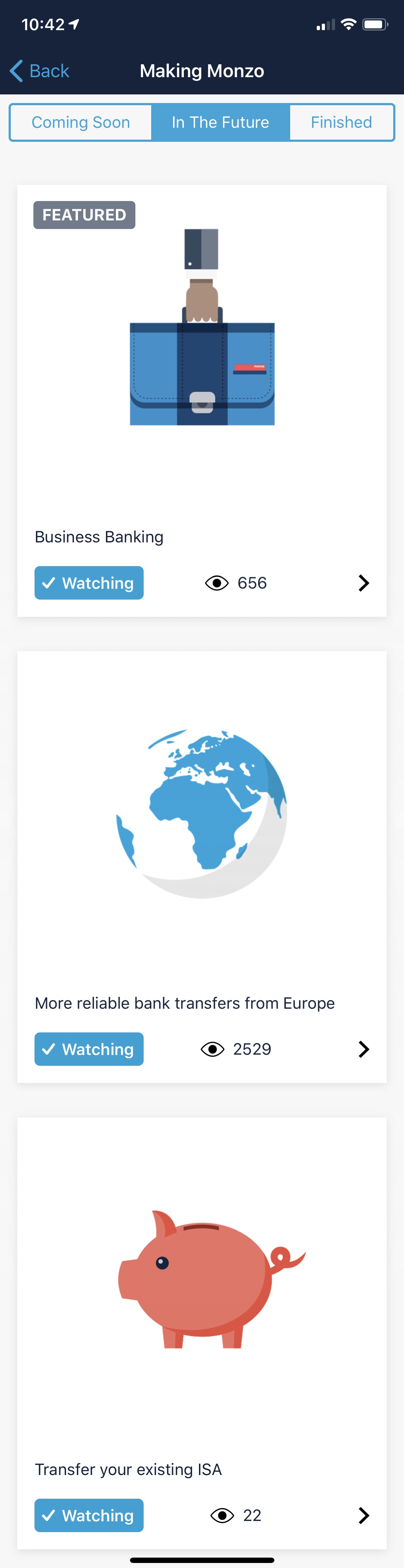

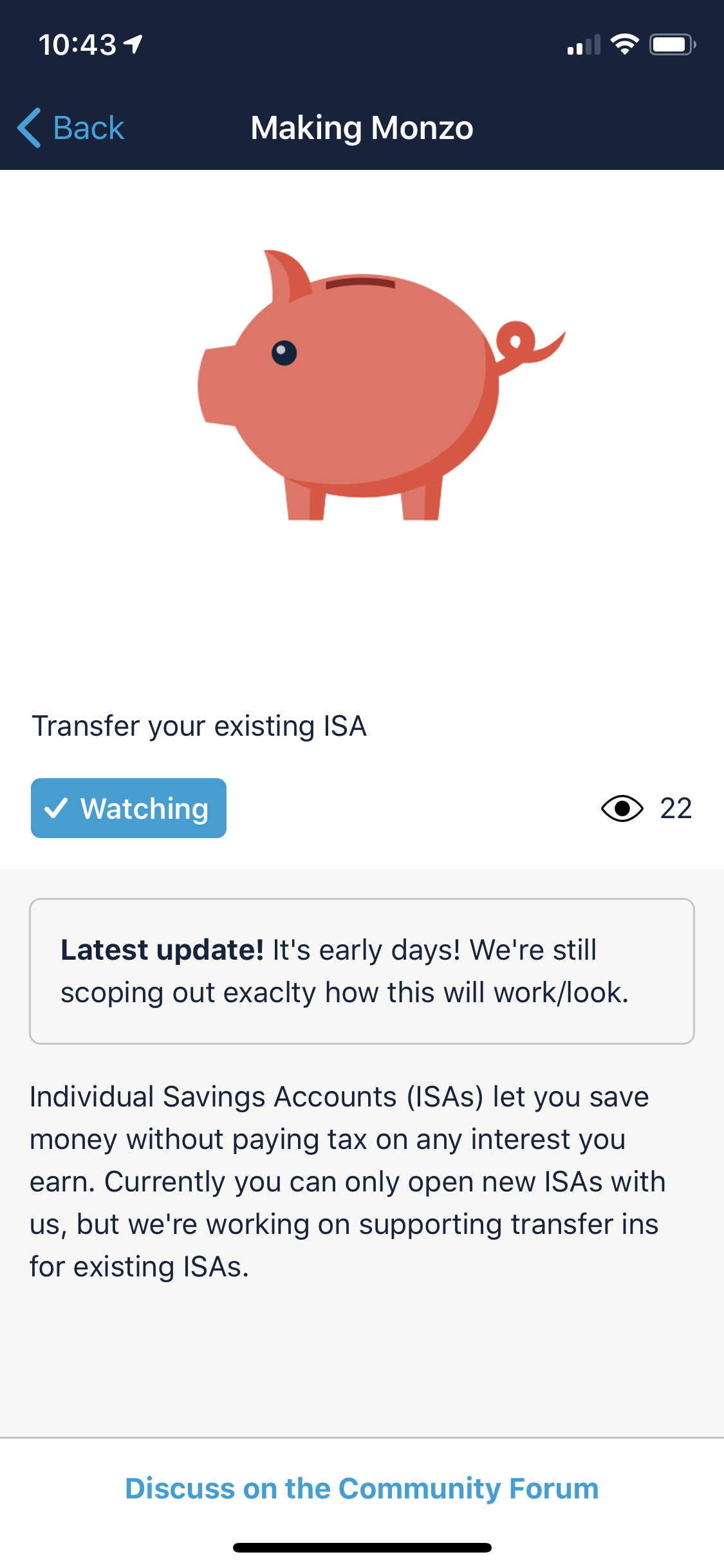

As @Feathers has said, it doesn’t appear that transfer IN to the Monzo ISA is functional as yet.

That’s a perfectly acceptable way to do it. If your existing ISA has a higher interest rate, of course, then I would keep putting money into that one…

Quick question: does the National Insurance check auto deny you if you already paid into an ISA this year? I genuinely can’t remember. I seem to have successfully made a Monzo ISA though…

Thanks for this! I’ll compare interest rates and transfer my cash into this if it’s better when the new tax year starts if transfer in isn’t available yet

I don’t believe it auto-denies you, although I’ve never tried - not sure if at some point HMRC will come knocking as they would have the data I would’ve thought.

I deleted it and will wait a few days hah. Will be interesting to see if it gets flagged if I did do it wrong.

I presume (again as I haven’t done it or seen what happens if done) - that if you simply open an account - nothing will happen as you haven’t “cheated” any tax provisions.

However, if you were to pay in - and receive tax-free interest, and you then went over your PSA (for arguments sake say you were an additional rate tax payer so you don’t have any) - you may have to account for that tax free interest. That would be how I see it anyway - although again I have no real way of knowing.

EDIT: found an article from back in 2015 - Paid into Two ISAs

Did this get emailed out too early? I click flexible savings pot and it gives me the message saying they’re coming back soon.

Is your app upto date?

Yes

Seems like an unfinished page. The URL to ‘Create a Pot’ only works on mobile, and only if you have Monzo installed. Is it meant to only be accessed within the app?

Just make sure you aren’t trying to access it from your Joint Account. Monzo have not allowed Joint ISA’s, so can only be created from your personal account.

Yes. There’s no ability to create pots via any other mechanism than the app.

Another bug in the app it seems. Support asked me to uninstall and reinstall. Annoying how often this is the step that resolves things

I don’t think it’s to resolve things, I think it’s the first port of call to clear any caches etc. It’s surprising what it can clean up just by a reinstall which doesn’t take very long at all.

Sure - but a poor user experience. I shouldn’t need to do this to make a feature work.If the cache needed clearing shouldn’t this be done when the feature flag is enabled or during the required update?

I know it does’t take long - but I have to remove the app, download the app, place it back where it was on the home screen, then sign in, wait for email, re-enable the fingerprint settings. It’s just a lot of friction. Perhaps I’m a little annoyed as it’s my third issue this week and second reinstall.

Just for my own clarity (and maybe others), am I right in thinking you can only pay into one of each type of ISA each tax year, but you can have multiple ISAs from previous tax years open?

So if I open a cash ISA now, then another one on 6th April, I can only pay into one of them during the 2019/20 tax year. But if I were to open a S&S ISA in addition to them I can pay into that as well as one of the cash ISAs?