I’d challenge your statement that everyone who downloaded the app already starts from a position where they trust monzo. I think this is exactly what is questionable as many people still only use it as a travel card or for joint accounts.

Ummm yes, thank you for that. So flip your statement round and the other side of it applies. We are agreeing!

You’re right, I just meant users, pardon me.

I guess with logos, it’s a bit of a slippery slope. Let’s say you put the FSCS logo somewhere prominent on the basis of trust. What if that priority shifted, and we wanted to heavily push ISAs? Then you might well say, put the OakNorth logo there to showcase the fact we have ISAs with them. And it ends up as advertising space, effectively.

I never disagreed

Neither did I  All good!

All good!

But then you’d be treating it differently.

Go back to the original idea - if it’s to add confidence to new users, I say why not (I mean, please don’t it’s ugly as hell) but you aren’t advertising the FCSC you are 'adding familiarity. Adding OakNorth will mean nothing to ? most ? people?

Anyway, just shooting the breeze here. I’m happy either way!

I think if the only thing stopping you from using Monzo is an FSCS Badge, then its an education point - its all available for any consumer to see Monzo are protected and therefore your funds are by doing a quick google.

Are consumers deciding on who to bank with on the FSCS Badge alone?

The reason why it might work for users could be more down to psychology rather than their knowledge of what fscs are.

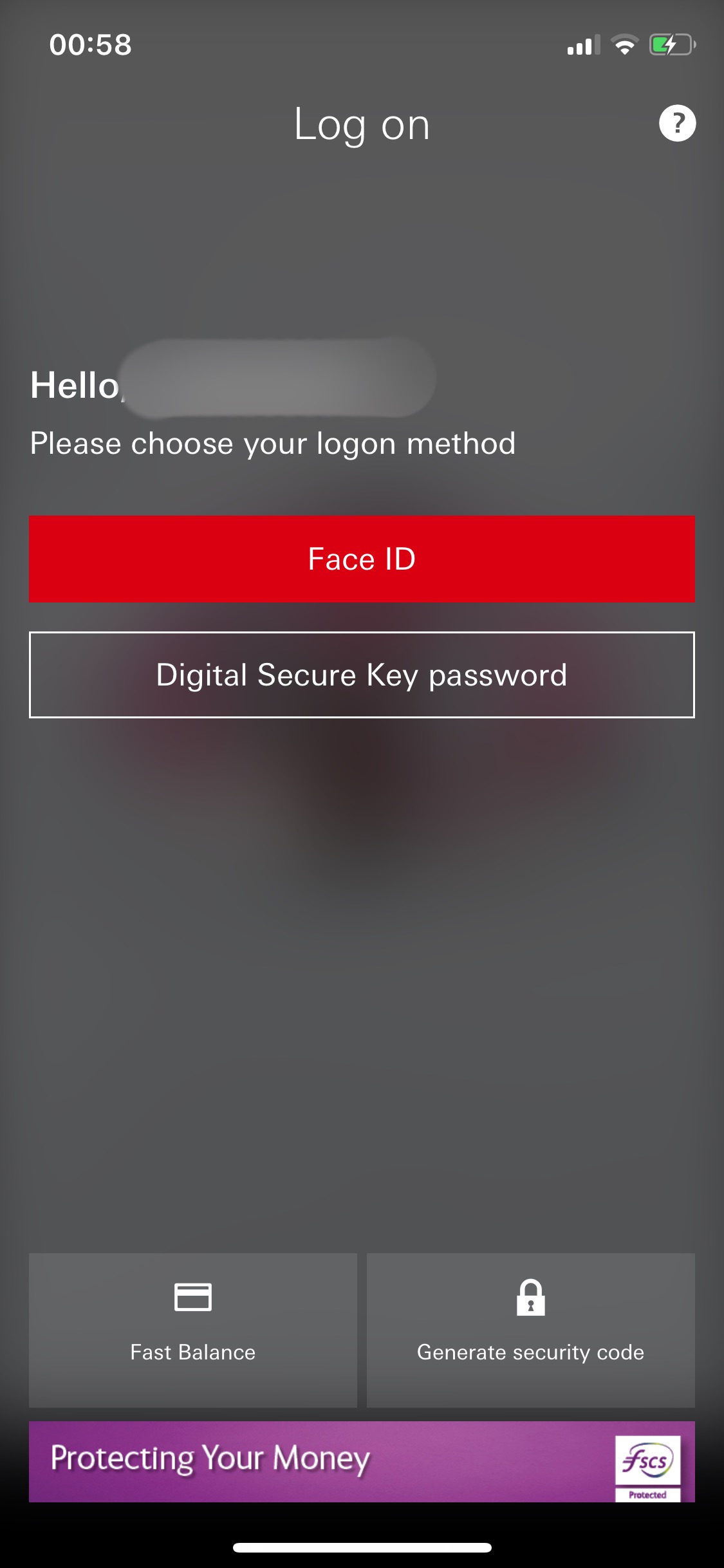

From RBS…

Yes, including logos to increase brand trust is definitely a consumer psychology piece of work which is marketing/advertising if we want to call it that.

However, fscs is something that represents the trust people have in traditional banks. Would be interesting to research some case studies on traditional banks and why are they including it on their apps, pretty sure there are some researchers out there who can answer that.

It’s not to push a new product (i.e. your example on ISAs) but more to help build brand image and say, it can be trusted the same way as traditional banks.

I actually believe Monzo is under an obligation to promote the FSCS so am surprised if the logo doesn’t appear anywhere.

The FSCS state:

The Financial Services Compensation Scheme (FSCS) works closely with the industry to promote awareness of the protection it provides. This is part of building and maintaining consumer awareness.

FSCS, the Building Societies Association and UK Finance have forged a comprehensive agreement about how their members will use the FSCS badge across a range of channels, including digital channels, advertising and disclosure.

This agreement builds on the disclosure requirements set by the Prudential Regulation Authority that require all authorised banks, building societies and credit unions to inform new and existing customers that FSCS protects their deposits.

Monzo is a member of UK Finance who said in September 17 that:

"Under a new voluntary agreement, starting this week, UK Finance, the Building Societies Association and the FSCS have agreed a package of measures for retail customers’ savings and current accounts, including:

- Publishing the FSCS badge on relevant website pages, i.e. product homepage and login page where customers go to view their cash account.

- Incorporate the badge at least once in a prominent place in the customer journey on mobile banking apps.

- Adding the badge as standard to the standard FSCS information sheet presented to customers at account opening.

The agreement will underpin consistent use of the FSCS badge by banks and building societies across the most effective points in customer journeys to promote FSCS protection.

Firms have up to 18 months to implement the agreement in full and will be subject to FSCS mystery shopping."

It isn’t prominent in the Barclays app quickly looking at it.

It’s not on the Barclays app, nor is it particularly prominent on their online banking (a small icon on the side bar of the login page).

It will be on lloyds, BoS, and Halifax as their all the same bank and likely have a unified rule to use it.

It says it’s a voluntary agreement? I would imagine if it was mandatory Barclays would have done it by now.

As for its effectiveness, I don’t believe there is any evidence to suggest anything on this, and for Monzo at least, the login is fast enough that you’d barely have time to read or see it.

New users should be well aware of the protections as Monzo should probably be giving them the relevant information to their email account when signing up, or giving them the relevant information on the sign up page on the app. showing a FSCS badge after a user has joined I don’t see how that would convince them Monzo is safe, they already signed up.

One thing I did notice is it doesn’t look like I ever got any welcome email when I signed up with all the information I should need, including information about FSCS protection. Maybe I deleted it. Do new users get the information they need at sign up?

Ironically Barclays is one app I don’t have… are you saying it’s not prominent or totally missing from the app?

As well as the FSCS logo appearing on the Lloyds stable of brands, it’s also included in the HSBC, First Direct, Natwest, TSB and Tesco Bank apps.

The PRA rules to inform new and existing customers that FSCS protects their deposits are a regulatory requirement and not voluntary.

Most legacy banks tend to write and/or include a leaflet with statements each year.

The above quote was in reference to displaying it on login pages and other areas and the first line says it’s a new voluntary agreement.

As for Barclays, there is no FSCS logo on the login page or other prominent pages on the app. There is a clickable logo on their web login page.

That presentation of the logo for RBS at least looks fairly in keeping with the app

It is shown during the sign up flow. All users will have gone through the flow as Monzo only accept signups on mobile!

I don’t really see the point of seeing it everytime you open up the app… It’s in a lot of marketing material, the website, the account creation flow and in the help docs.

Barclays don’t include it anywhere in their app. I would imagine this is down to a design decision as is Monzo.

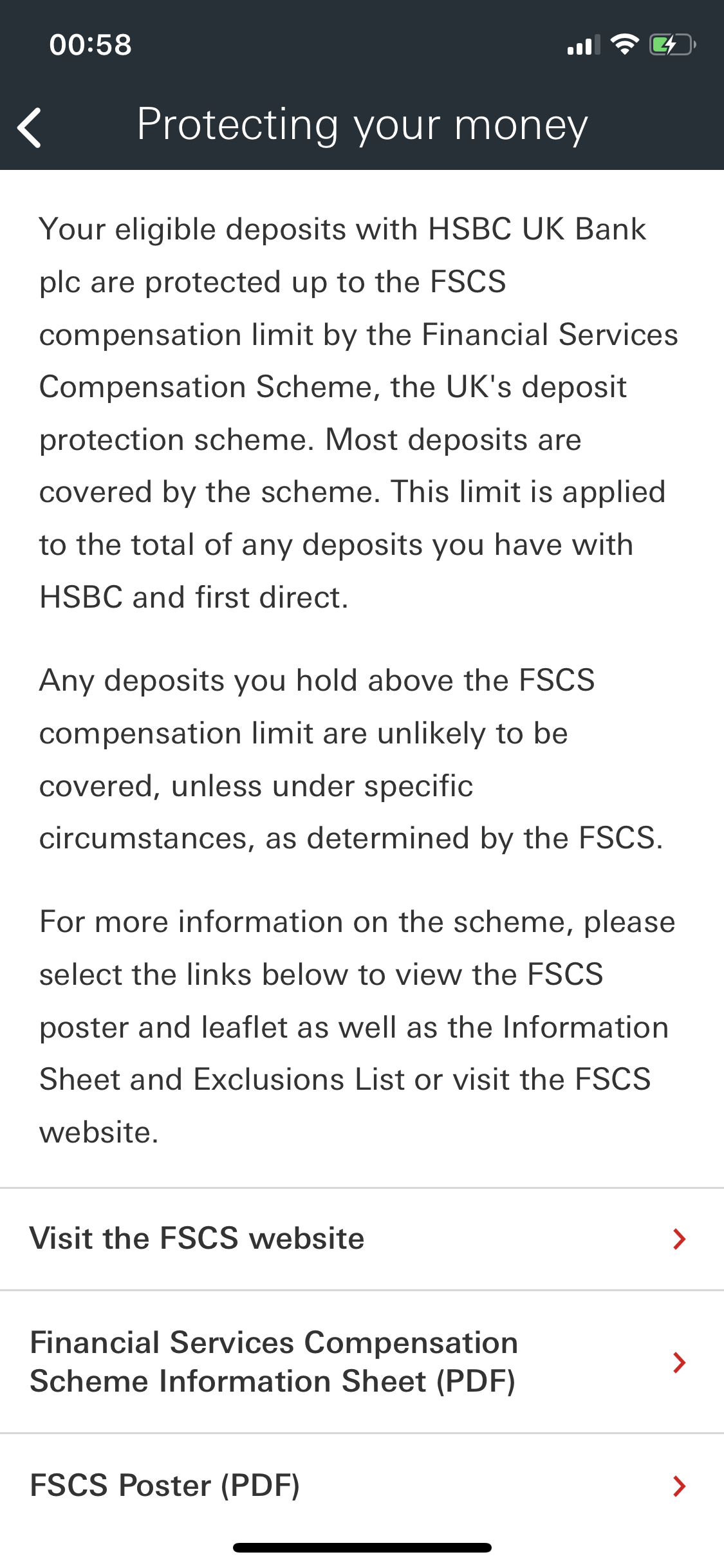

I do however like how HSBC integrate this into their welcome screen, although not the cleanest of designs. If you ‘press’ on the FSCS link at the bottom, it takes you to a screen where you can read more about and so helping to educate the consumer. Rather than just a logo that may not mean anything to you.