I’m not sure how useful CASS would be for people that like their bills segregated because don’t the other accounts within Chase have seperate account numbers/sort code, so you’d have to manually move them yourself anyway?

I pretty much already use it as my main account; it wouldn’t be hard to move over the couple of direct debits I have.

I still don’t understand why 1% cashback on a debit card isn’t given more… umph by some on here. It’s literally unheard of and a brilliant USP. If Monzo had done this it would have been celebrated to no end ![]()

I’d say it depends on how Chase have implemented DD’s once it officially goes live and how it would work with CASS.

If it’s a case of each ‘pot’ has it’s own account number (which it does) and you have to setup the DD with the correct details at the point of the retailer, then for CASS I suppose the answer would be as part of the setup you’d just have to tell Chase which pot to setup bills into?

If, and this would be slightly more exciting and a more ‘useful’ USP if Chase allowed you to move the DD’s between pots as well after they’ve been setup. So, they do default to your main account, but you can tell Chase to pay out of the other pot and they’ll do whizzy magic internally to route the payment correctly rather than relying on having to give the retailer the correct account number in the first place. Each pot having it’s own unique account number is still useful for paying directly into them (or setting up standing orders) but you’ve then got the flexibility of being able to move things around when needed (like Monzo Bill Pots etc.)

Don’t forget with CASS though it’s more than just moving your DD’s across - it’s also the guarantee that any payments into your old account will be automatically routed to your new one as well.

I do both. I’ve currently got two small charity direct debits for an account that net me some funds and two normal ones in another bank that net me some more. Plus then any other spending I get 1% cashback on via Chase.

Even if Chase offered money for direct debits it’ll always work in my favour to have a couple of banks open to get their rewards.

So in that sense I already mainly bank with Chase, since the others are used purely for direct debit money back.

It’s only for a year, though, and then you have a mediocre account with round-ups.

I’ve made a nice bit of change from the 1% cash back and also the Amazon 3% cash back during the Christmas period. I’ll be using Chase until my 1% offer has expired.

But then you have other banks who just do a flat ‘here’s a bribe if you switch’ deals like First Direct. How many stay with those banks after they’ve switched?

It’ll definitely be interesting though to see if they extend the 1% offer, or come up with alternatives (like 3% spend at specific retailers) in the Autumn.

Sorry am I missing the other banks that offer this?

I’ve literally already made more money than I ever would with another bank in less than a year.

I maintain that if Monzo offered their free customers a year’s cashback on spending at 1% it would be on every post going.

You’re a one man Chase cult!

Maybe you have a high disposable income and and making it work for you. That’s great. But you can regularly get £100+ for switching accounts and you don’t have to spend £10k on your card to get it.

You’re right - they are unique with this. I’m looking at this from my own perspective, though, and I don’t spend enough on debit or credit cards for it to make a massive difference.

I’ll be keeping an eye on it, though, and I’m not going to close my account. I’m not particularly bothered about CASS but I really would like open banking.

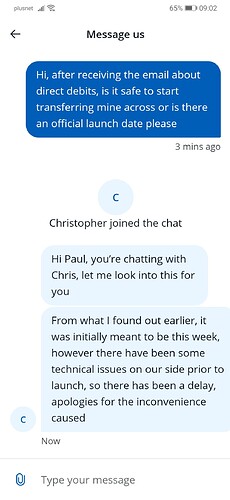

Interesting to see the progress with Chase, seems like it’s happening.

Wonder what will make them really stand out in a sea of “similar” accounts though.

I’d be interested in seeing what savings rates they bring over time.

I know. I do both. It’s not either or…

But most people aren’t going to be bothered about trying a new bank, that’s lacking the features of their other bank, to make £40.

If you spend £20k on your card in a year then it’s worth it for you.

But the question was “once direct debits are launched” so they wouldn’t then lack features.

Most people don’t switch banks full stop, that’s just a fact of life.

I don’t even advocate one bank account, like most here I use a few to maximise my own rewards.

Sure it’s only £40, but it’s a few minutes to open and it’s at no extra hassle to me to pay via Apple Pay with a different card. So it’s essentially free money.

In addition to any other rewards from other banks and any switching bonuses.

It’s only a year, but arguably switching bonuses are only allowed once every few years so eventually you run out of those too.

To the ‘average punters’ (ie - not us) which offer do you think sounds better? 1% cashback on all purchases for a year, or a flat £150 (like First Direct).

Ok, if you then sit down and work out how much each offer will give you, you’ll realise to make more than £150 in a year you need to spend a lot but to me, without doing the sums, the 1% offer seems better.

It’s almost like how politically it’s always difficult to try and convince people to increase taxes to higher earners, because even though most people are not affected, everyone aspires to be that higher earner so they feel they could be affected one day. So, even though you’d have to spend £15,000 to get more than £150, people would still feel that they would like to do that.

Personally I think cashback sounds better but I can totally see the other side too.

Though my argument is for both really. I don’t think anyone who is swayed by these promotions to all different banks has just one sole account anyway so it’s just maximising your own returns.

… this has peaked my interest.

Less hassle? I’d disagree with that. There’s definitely more T+C’s to cover with switching bonuses - for example with First Direct having to switch with CASS and pay in at least £1000 and you’ll get the bonus 30 days after you’ve qualified for it, oh and you can’t switch an HSBC account etc.etc. whereas with Chase, you setup the account and then click the ‘I want cash back’ button and that’s it and start earning it immediately.

And the whole 1/4 vs 1/3 burger fiasco was more a statement on the intelligence of Americans and not understanding fractions. 1/2 burgers sell absolutely fine though.

But then you’re comparing apples with pears.

If you fully switched to Chase (just like you would have to ‘fully switch’ to First Direct to get their bonus) then you wouldn’t need to deal with the hassle of transferring money into your Chase account before getting the 1% cashback. All your money would be there already.