Awesome!

Oooo very good. That’s actually not a bad offer. Not much but it’s then better than my Amex reward at Amazon:

In Monzo’s case that usually seems to be because no one there understands how anyone over the age of 25 uses a bank account

Oh, this looks like a nice offer. I’ve been eyeing something which is already £20 cheaper on Amazon than elsewhere, and with this cashback it just gets better. But I don’t trust Amazon’s returns policies and had more than a few bad experiences with deliveries. Oh and I don’t want to give Bezos more money to fuel his space-penis. But then again, free cash…

Like this particularly in the run up to Xmas as I usually do a fair bit of my present shopping at Amazon

The whole statement here is incorrect. Section 75 is a statutory right. Ie it’s enshrined in law.

Whether it applies or not has nothing whatsoever to do with the card you use or don’t use, but whether and how you took out credit to purchase something. Indeed you can get Section 75 protection on non-card purchases in many circumstances.

Indeed. I think it’s as @TheoGibson put it in the flex thread here:

So simply pairing your card to a theoretical credit account in the Chase app as opposed to one of your regular current accounts is enough to grant you those section 75 protections, because you’d be paying directly using credit. The card is irrelevant.

I think there’s also scope here in Chase’s approach for the possibility of seeing the ever often dream of @Peter_G’s that crops up once in a while on these forums, of having a singular line of credit that serves multiple purposes such as being both your overdraft and your credit card. Whether or not they’ll actually do something like that remains to be seen. But one can hope.

But I generally see a lot of potential in Chase’s take on banking and there’s a lot of excitement in the potential of it for me, more so than I feel about our neobanks.

It applies if you make a direct payment using a credit line. To my knowledge, unless chase invent some black magic workaround, there is no way to use a debit card to pay directly from a credit line and hence S75 would not apply

Be slightly careful with my explanation here - this was very much a simplified view.

The real answer is - the law is complicated and S75 will be available if the company your making the purchase with says it is… And to make this decision the company that’s offering S75 protection has almost certainly consulted a law firm to be sure of the finer details.

Does a card’s PAN define what you can do with it? So theoretically could the Monzo debit card be linked to Flex (or the Chase debit card linked to a credit account), or does the card being a debit card limit it’s capabilities from the get go (hence the need to a Foex virtual ‘credit’ card)?

So in the US many moons ago I had a card that was both credit and debit. When I paid using it, the machine/cashier would ask which account I was spending from.

It’s never been a thing I’ve seen over here; I wouldn’t know how it would work.

But if I paid with a card, and within the app I had it set to a line of credit, I don’t see why that wouldn’t be covered? Then I can choose the debit account as well whenever I wanted.

No idea - I’m pretty sure we can link the Monzo debit card to Flex if we want - We’d almost certainly lose out on the 0.1% interchange increase you get with a credit BIN but what it means for S75 I don’t know - We’d ask our compliance/ legal team ![]()

I don’t think our statements contradict each other (at least I didn’t mean to contradict any of your as yet unwritten statements  ):

):

Firstly, I said that section 75 depends on “whether and how you took out credit” (emphasis added) - never did I say or imply that it applied to “just any credit”

Secondly, my only point - and I should’ve made that clearer - was that whether the card identifies as debit or credit card to the merchant is totally irrelevant. What matters is the product behind it. We know there are debit/prepaid cards that identify to the merchant as credit card - that won’t mean that S75 suddenly applies. And whilst I don’t know of any currently existing credit cards that masquerades as debit cards to the merchant, doing so would not invalidate S75.

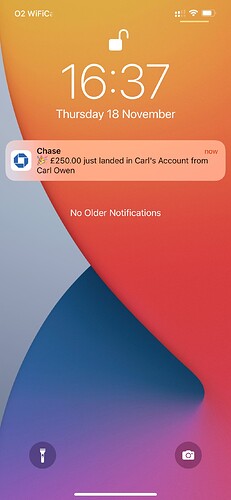

Yes the amount is new recently but the vibrate and tone has been up and running for about 2 weeks

I wonder…

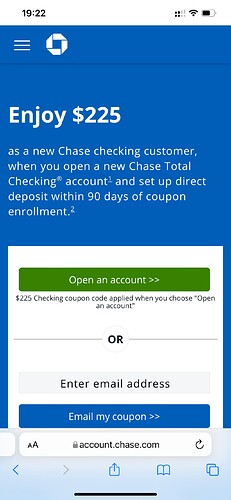

Once direct debits are set up would Chase consider offering an account opening bonus similar to their US offering of $225 (£166).

Like many things in the US, I don’t think the words are doing us any favo(u)rs here.

As I understand it, they have a domestic card network they call “debit”. Broadly, in our terms, consider it Switch before it was bought out.

Then they have the “credit” network that’s broadly MasterCard and Visa. On the US “credit” network you can run both debit and credit cards (in UK terms). Which is why, I think, when you go to the US to pay with your (well, not your, @coffeemadman ![]() ) Monzo card you need to make sure it’s using the credit network.

) Monzo card you need to make sure it’s using the credit network.

It’s confusing (and doesn’t necessarily invalidate what you said) but I thought I’d throw it out there as the US banking scene is still kinda in the 70s.

I lived in NY for most of the 00’s - had a HSBC (US) ‘checking’ account and an AMEX (NYC) credit card. HSBC was absolutely prehistoric. AMEX was amazing. But neither were digital as we know it now.

(I think I’ve still got my HSBC checking account card with a pre 9-11 Manhattan skyline image on it - I’ll have to dig that one out for a look)

Banking in the US can be both old-fashioned and efficient. Monzo should be able to slot in there really well. But it’ll take either - a lot of marketing money - or - slightly less marketing money and a lot of time to break it.

Chase, on the other hand, should be able to do this easily as it is a vice-versa market move.

Little note here with Chase compared to Monzo and how both banks handle the cancellation of pending transactions.

Tested by accident, when doing a spot of Christmas shopping tonight.

Purchase #1 - paid with Chase but forgot to pay for gift wrapping. Cancelled and ordered again. Was refunded immediately and Chase Notified me, and my available balance went back up, and the pending charge for the first order disappeared from my transaction list.

Purchase #2 - bought another gift and accidentally paid with Monzo. Cancelled and ordered again using Chase. The transaction is still pending in Monzo and hasn’t been returned.

This was a bit of a pleasant surprise for me, because I never expected a refund to happen that fast. And now it has. And thinking back on this, the same was true on a cancelles Uber in France as well. The pending charge was returned to me straight away after cancelling.

This has raised the game, I think, and makes Monzo look legacy here.

Also, Chase send an SMS for these as well. I presume because the pending charge is voided, so the transaction no longer exists, which means there’s nothing in the app associated with the transaction anymore.