https://blog.difitek.com/are-traditional-banks-approaching-their-kodak-moment/

No.

(joke)

Surprised this was closed down so readily. It’s an interesting and thoughtful piece that I thought would be of interest to the community.

Short answer: No

Long answer: Kodak were a fairly large company invested in a medium that was in many ways superseded by digital imaging and were forced to evolve. They removed some products from their lines and shrank rapidly throughout the 2000s. Parts of the business are still around and they still produce film, albeit in much smaller quantities (although sadly not Kodachrome…) and some digital products.

Whilst banking is evolving, it will likely evolve in a way that, whilst challenging for the big banks initially, will eventually end up benefiting them just as much as the newer banks, especially in terms of the costs of doing business. Costly branches will continue to disappear, cash and cheques will continue to disappear, so the big banks will improve their margins and adopt some of the features the challengers are offering but with the advantage of a larger and somewhat static customer base.

So whilst Kodak is a shadow of its former self, it will probably never return to its former glory and be the market leader it used to be. Banks on the other hand, may be forced into evolving, but they are big enough and ugly enough to throw money at the problem and be able to match the younger banks feature for feature. However, the competition in this market is probably a good thing and will encourage change.

Probably better to say traditional banks are entering their iPhone moment. For a long time the Nokia N-series was the height of smartphone technology. Then the iPhone came along in 2007 and forced everyone to think again. Nokia is still around, still making smartphones just like everyone else in the market.

The big banks will probably end up looking more like the challenger banks, in time.

Think the era of high street bank dominance is over but they’re not going to become irrelevant anytime soon

I would strongly disagree as 1st most people don’t change their bank even if it’s awful. I don’t know maybe it’s because they want to have something to moan about I guess.

2nd The older generation won’t want to bank with a faceless organisation. It’s almost always easier to talk with somebody face to face.

It was closed and then reopened immediately in response to an observation in the comment above that it was settled as a debate already

The thread was never actually closed and probably will not unless left alone or it spirals out of control

I’m entitled to my view based on the stats that are freely available

I would also strongly disagree that the era of high street bank dominance is over since over 96% of UK customers have account with a traditional high street bank.

I’d agree that their era of dominance is starting to come to an end though.

Not sure I agree with these statements though. People less comfortable with technology, which does tend to include the older generation, would definitely be hesitant to switch over to a branchless bank. However, I’m sure a number of them will find Monzo much easier to work with than current high street banks in the long run (eg: they don’t have to walk/take a bus to their bank to get their questions answered).

Also, I disagree that “it’s almost always easier to talk with somebody face to face”. I’ve found Monzo COps to be generally more clued up than high street bank branch employees and if a COp doesn’t know the answer to a question, they can usually refer you to someone who does so you can get an answer to your question without leaving your house.

Should have worded that differently

They still have the vast majority of accounts but neobanks are now a viable alternative which I can only see increasing their market share. The oligopoly is over even if it takes a while to be seen reflected in overall customer numbers

What sort of things do you think Monzo needs to do to become acceptable to a mass market?

Now heard it from you across more than one thread on here today

Which fintech banks are super accessible when probably the largest one in the UK is not? What should they be doing if not growing fast and having greater viral marketing?

Buying this

It has been the case before in other industries where the major players are still winning battles, but do not know the war is being lost

Starting to happen with car manufacturers

No.

Kodak made their money from film, photo paper, and the associated chemicals needed to develop them. That was rendered obsolete by digital cameras.

If we look at the banking sector, can we see similarities there? Traveller’s cheques have been rendered obsolete by payment cards. American Express are the market leaders in traveller’s cheques, but they also have successful payment cards business with an app that is every bit as good as any of the fintechs, so I think they will be fine.

But, if you look at for example Barclays. Is their core business model going to be made obsolete? No. Some of the products, and some of the ways they offer their products will. But they have an app, it’s not as good as Monzo’s, but improving and modernising they way they run their business is not a challenge on the same scale as finding that nobody wants your core product any more. Barclays with a Monzo-like app and in-app customer service is a believable proposition in a way that Kodak selling camera phones is not.

Foreign exchange bureaux, I could see them disappearing in the future. When I can go to France and spend / withdraw Euros in exactly the same way that a French person can, I don’t need to go to a special High Street shop for foreigners.

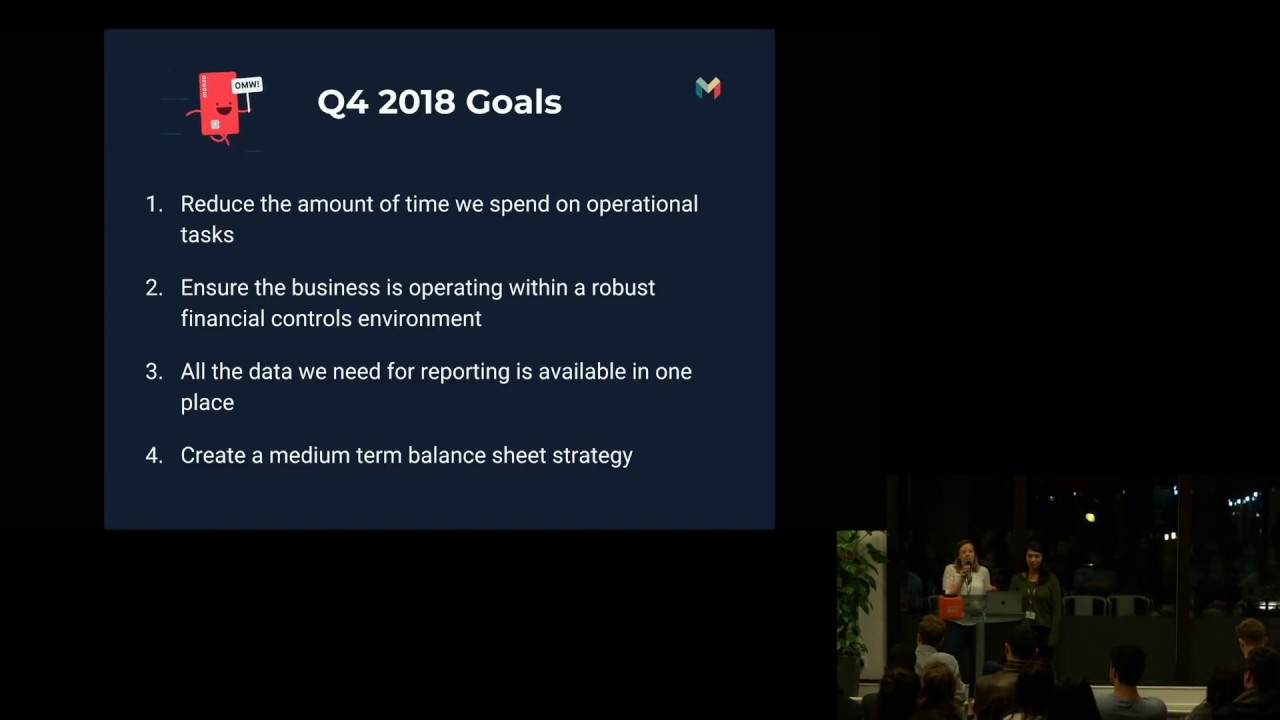

For most banks no, due to the high costs of running bank branches, ATMs and legacy systems. However, Monzo focused on achieving positive customer unit economics last year before focusing on growth.

Customer Unit Economics Explained

For every new customer, the amount the Monzo makes from them is per year, on average, slightly more than the cost of running their account (including customer service costs). So every new customer Monzo get reduces their losses and will eventually add to their profits.

Monzo are not profitable as a company yet though, because the amount they pay their staff (eg: developers, lawyers, executives) and stuff like the amount they pay to rent their office buildings or one-time costs to join payment systems is not included in that net positive amount gained per year per customer. This is because you can service more customer without changing the number of developers you need.

NB: the amount paid to COps is included in the customer unit economics because if you get more customers, you need more COps to maintain the high quality customer support.

This part of a video from a Monzo Open office explains it well:

Partly I do, but that is answered already above

Do you think that constantly onboarding more users is somehow a sign of not being acceptable to the mass market?