I’m going to try Yonder out. Just going through the final checks now before they let me know. I’m not from London but they say it will roll out to other cities. I actually have a good feeling about this card if they are trying to compete with Amex. I’ve seen their videos of how high tech they want the app to feel with their AI systems etc… so maybe a CC to watch. I’ll not be closing the account (if I get it) coz I did that with Chase and they don’t allow customers back once it’s closed…. Well for now. - also love the Yonder card design ![]()

If only they had open banking

Interesting, let us know how you find it. When it first launched, it looked heavily London centric and (perhaps unsurprisingly given the startup monzo era staff) very “I built this cool thing for my needs” approach. In that if you were not affluent, London based and into going to posh events, it wasn’t the card for you.

There was a thing here, and while I think some of what happened was down to cultural differences (Aussie v everything else) I decided after that point I’d never touch them even if the card had local to me offers etc.

Also, were FD not looking at partnering with them at one stage? The whole thing is super weird.

There’s a good reason no-one trys to really compete with them, so more fool Yonder for trying to. Amex knows what it is and does a good job of doing just that. Most other providers assume if someone is going to get an Amex they will, so tries to offer a likeable alternative. But not from a competitive stance given its a non starter.

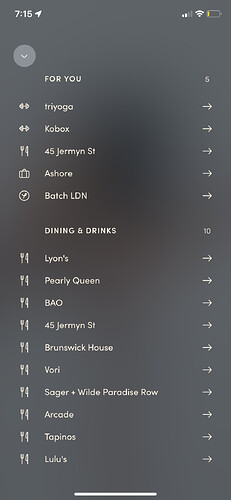

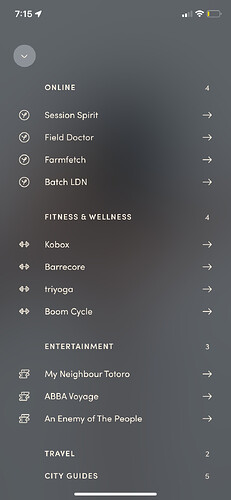

I’ve been with Yonder for nearly 18 months and I have been incredibly impressed! I absolutely love it and use it as my main card now. The points are generous and the process to redeem them is super duper easy. It’s giving me Monzo vibes c. 2016… i can see the direction they’re headed in and given how young the company is, what they’ve achieved so far is awesome. I invested in their crowdfunding round. They’ve moved into much more than just restaurants but I’ve only used them for restaurants because thats what gives me the most value personally. The recommendations are always very good… feels like a free date night once or twice a month depending

If you weren’t a long standing member here, I’d think you were a shill!

![]()

![]() Thats fair!! I just think it’s a great product… I’ve read some comments about a Yonder employee or maybe even the founder messing around in the forum… but i never saw that stuff, so perhaps that’s why I don’t have a sour taste in my mouth about them

Thats fair!! I just think it’s a great product… I’ve read some comments about a Yonder employee or maybe even the founder messing around in the forum… but i never saw that stuff, so perhaps that’s why I don’t have a sour taste in my mouth about them

I just cancelled the application. I was tired of waiting (2 days). Also saw some bad reviews about cards being frozen and accounts closed. Maybe I should just stick to my flex and having all my eggs in one basket (Monzo). ![]()

Probably the same people who have their accounts frozen/closed at Monzo! Usually for good reason (although not always)

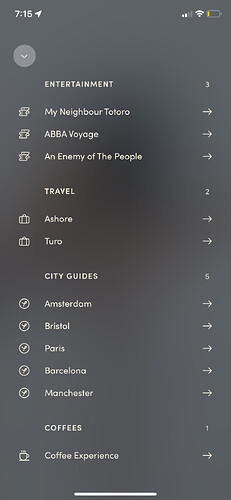

I just rejoined. Offers seem to be widening in scope since I was a founding member, and Yonder has given me double the credit line.

Realigning all my subs onto the card, and also going to pay my council tax on it which should in itself net me over 8,500 points a year.

Dare I say it the app is even slicker than before, and I was always very impressed at the way points are redeemed (even partially) ‘server–side’ in the app without faffing about with codes or pre-booking, and not even having to explain to the establishment what you’re redeeming.

Does anyone have any screenshots/info on the rewards now on offer?

Interesting.

For example though what is the ABBA Voyage one? It’s the only one I can directly compare to as I’ve paid for that before.

It works a little differently … you earn 5 points per £1 spent. You can use the points to redeem part or all of the bill. If you opt to redeem £60 and the total bill is £70, then it would only charge you £10 (for example)

In this instance, £60 is 13,600 points which equates to a £2,720 spent on the card. It’s somewhere around a 2.5% reward rate usually, I think

Question for those with the Yonder membership card. Do you know if the worldwide travel insurance covers cruises?

I’ve currently got the Monzo premium account for this very reason.

Opened the Yonder membership card mostly for the restaurant benefit; two that I’ve been wanting to try are listed ![]()

![]()

To claim against the travel insurance policy I understand with Monzo one just has to be an active premium member whilst Yonder state the holiday has to be paid or parts of it (the bit your claiming) with the Yonder credit card. Seeing as all my holidays are paid this year it’s not really going to benefit me.

Still I’m sure I’ll enjoy the restaurants nonetheless. “Hello, is this 45 Jermyn Street, yes I’d like to make a reservation” ![]()

![]()

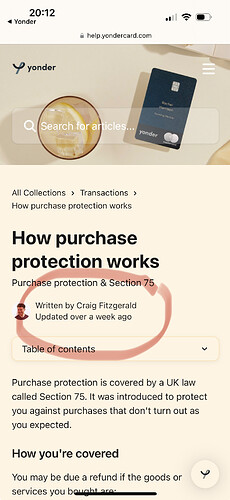

I think this is their way of trying to be friendly and ‘hey we’re your cheeky mate’ in communication. I thought the same thing with the insurance cover. It was a bit wishy washy with the detail until of course I looked at the contract for the boring wordy version.

I like this approach though.

People might not be familiar with ‘section 75’ but will likely know credit cards have added protection in some instances.

Simplifying for a wider audience isn’t a bad thing.

The long and wordy will be in the t&cs.

Agree that the wording should be accurate. To tell you the truth I see section 75 referenced like this all the time. Even I didn’t pick up on what you meant at first. I thought it was because they say ‘you may be covered’… I guess more copywriters need to pass it through legal.

Craig run… someone’s coming for ya mate!

Lots will.

But this particular one is the only one “known” as S75.

It’s not incorrect. It’s what it’s known as. As in, it’s what people refer to when you say “Section 75”.

They aren’t saying this is what the law is called, they are saying it is what it is known as. A subtle difference.

It does literally say “a law called Section 75” though. So they are calling it that.

It’s one of those things where people will know what you mean when you just say “Section 75 protection” or “it’s covered by Section 75”, but I think banks need to be carful not to fall too much into overusing colloquiums.

I thought they usually need to be quite careful when referring to anything to do with laws or regulatory restriction/requirements which is why there’s often an asterisk with a more log winded explanation or all the small text at the bottom of TV ads, they have to be quite clear in the wording.