It’s taken them years and they still have no clue how to set it up it seems.

I only know what I had been told with this one by some work colleagues discussing it - and then noticed all the paid for ATMs near me had disappeared from bars and the local market. So you are probably right in this case, I’m only going with 2nd hand information and noticing they vanished here lol.

With the annual operating costs for an ATM at approx £33,000 per annum I can’t imagine a lot surviving without fees.

I don’t think they want to do it in all honesty. I think we would have had some kind of update by now if they were going to do it

False.

Demand for physical money holdings are growing globally & it is a discredit to suggest that cash is only good for criminals bearing in mind the world operated an age with physical money before electronic money was even a thing.

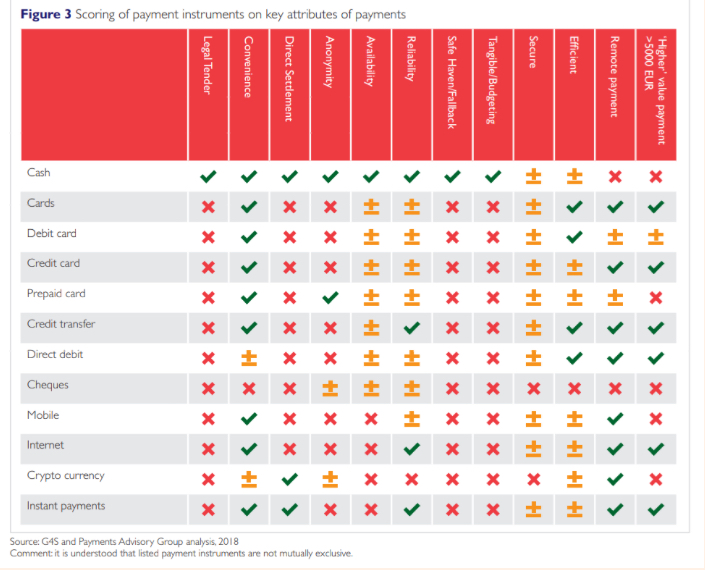

See below why there are more use cases for why cash is good for everyone:

Source: ‘Mo money, mo cash’ - FT Alphaville (Google if you don’t have a subscription)

I feel these sort of messages cheapen the Monzo brand. They already don’t have branches, they already don’t pay interest and they already lack a lot of key features other banks have. It also worries me if Monzo are trying to influence their users to constantly consider how they use the features that they make available and happen to also have have a direct cost associated with them then why make the feature available? It doesn’t make good business sense to offer a feature to everyone for free that has a high cost on the hope most won’t use it or will be considerate in it’s use. That did not work out for the free cash withdrawals abroad and arguably burnt through more cash than Monzo had hoped.

Whist I agree with the sentiment, I’m not sure that the “chief executive of G4S’s cash division” is the most impartial source, and I would have certainly put some of those checks, crosses, and neutrals differently

Asking the head of the “cash division” is like asking the Milk Marketing Board if they think milk is a good thing, you are not exactly going to get an impartial view.

You won’t be able to do that for much longer, as they’re shutting down their social media channels:

i suggest they go out for a pint

Absolutely, and this is expressly mentioned in the article. But as with all source material, be it primary, secondary or otherwise - all have value and it is for the reader to critically evaluate its worth alongside its provenance. In this case, I am of the opinion that the findings are indicative of a balanced reality (having widely read on this topic and with my study of Macroeconomics). It is very surface level to discount this source on that basis.

Also, please do say what you’d change in the diagram? I’m all for constructive discussion

I’m inclined to suggest that the user base of a product like Monzo is already far more attracted to non-cash payments than your average legacy bank customer. As such and as others have long since suggested, it looks like cash withdrawals from Monzo accounts are the result of spending & transactions that have no other option but cash so, pop up notifications about ATM withdrawals in Monzo is pretty much like flogging a dead horse.

Cash and non-cash use across society are both growing. Therefore, I’m inclined to counter that the average legacy bank customer is no more nor less inclined than the average digital-only bank customer to be “far more” attracted to non-cash payments. This is especially the case given that most of the user base of Monzo is likely to use both legacy and Monzo accounts in a complimentary manner at present. Monzo is just a way of “smarter” electronic banking… we don’t have the data (as far as I know) on its effect on wider cash use.

Like that isn’t a biased source… a cash handling firm - no cash, they have no business.

Ach, a headline will back up any point you want to make

My take: You’ll never live in a cashless society.

Wasn’t making a point. It just has good facts and figures about card and cash use from someone other than G4s cash handling.

Card use is rising, cash use is falling (although cash in circulation has risen) but it’s still a significant figure

Sorry. Bad phrasing on my part, I wasn’t scoring points. It was more of a general ‘lies, damned lies and statistics’ thing.

I am endlessly fascinated by folk who either want or seem to believe in a cashless future. Ain’t ever gonna happen, especially when we realise that life insurance companies are monitoring how often we go to McDonalds via Open Banking.

life insurance companies are monitoring how often we go to McDonalds via Open Banking.

Could you even name one life savings provider that allows to connect to your bank account, let alone requires it?

I’m surprised at people who say they don’t like cash. I like money in any form it comes in, I don’t discriminate.

Both have their place, can’t see that changing