I’ve just had a look at the private insurance. I’ve got care hire booked in for February so quite a while away. I’m not so worried about insurance as my credit card covers me but for 11 days hire it’s around 50 quid. It seems quite expensive (compared to free anything is going to be more expensive but that’s a lot)

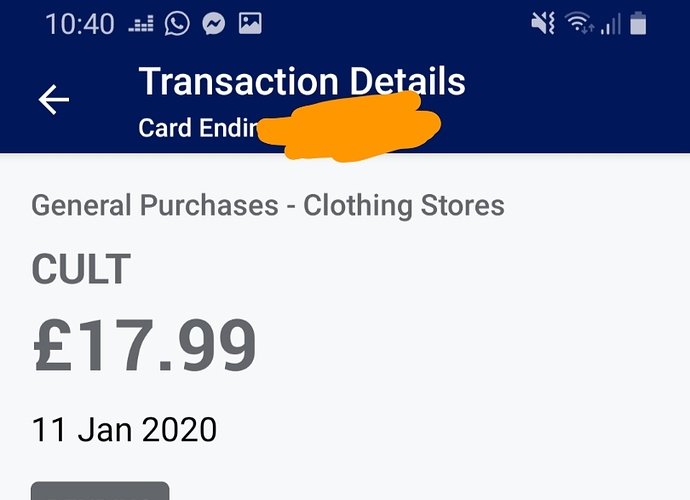

I’ve just got a quote myself just to check and it’s come to around £18-25 for 11 days within Europe in Feb 2020.

I should probably clarify that you do get a CDW included from most rental companies but most will also charge you to reduce the excess which is what we’re trying to avoid with excess insurance.

This is very true, and as with any insurance product you should carry out your own due diligence before hitting buy. The comparison site I’ve provided should help you to do that.

The company you hire the car from is also very important here. I now only hire from Avis and Sixt when I’m abroad just because I know they won’t rip me off (speaking from my own experience with these two vs other smaller firms) and I’m sure if anything did go wrong I’d be able to get the documentation I need, plus I have premium status at both now so I get to skip the queues at the rental desks ![]()

I like the ‘Offers’ that you can select on the app. Just using the day to day applicable offers (not spending for the sake of it), I have more than paid for my membership fees in savings and that even before I add in the potential value from Membership Rewards.

As mentioned a few times, Amex is widely accepted … cannot remember the last time I had to take out my MC instead. DM me if you are thinking of signing up and I will give you my referral code … we both get extra points

Here’s an interesting new co-branded Amex card - Vitality customers can earn up to 3% cashback via a new co-branded Amex card. 3% cashback is contingent on having 2 eligible Vitality products (e.g life insurance and health insurance) and meeting activity level targets tracked by certain activity trackers / smartwatches.

Considering the amex basic card (charge card) just to build my credit rating for when I want a mortgage in the future.

Put my details in the elegilbity checker and says I have a 9/10 chance of being accepted for it.

Either that or the everyday cashback card but I prefer a charge card as i’m not to comfortable with credit. (only a 4/10 chance too)

Considering i’m 18 but work full time amex have got alot less fussy in recent years.

I thought you were 100000% adamant you never wanted a credit card or anything like that?

Decided against it after all.

Had a bit of a change of heart but still think it’s not right for me.

I’m a student and AMEX gave me a card and have quite rapidly increased the credit limit. Think they have relaxed their risk criteria in recent years.

Might consider the basic charge card for my business

Going to hold off but amex seems to be one of the best credit card companies to use. (My dads only credit card is with them and he said the service is second to none)

Holding off as I prefer to have everything display in monzo and the amex intergration is on hold. (Monzo credit card I would consider)

I’ve become more open minded to credit cards but they should only ever be paid in full.

Amex’s service is excellent, but acceptance is not universal and none of their cards have fee-free foreign spending (at least, none of their free cards). So when you do start using credit cards, if you go for Amex you will likely have to get a second credit card to cover you where Amex is not accepted and for use abroad.

Therefore if you are concerned about handling credit I would suggest going for a single Visa or Mastercard credit card which has fee-free foreign spending instead (assuming you envisage spending money abroad in the next few years, in particular paying for hotels or hire cars). A single credit card would be easier to manage than multiple.

Amex customer service are up there with First Direct. I’ve only ever had to call them twice (to change my address) but they completed it quickly and seemed very cheerful.

You also get good offers through the app, I’ve had some great cashback deals from Hugo Boss, 5% back at morrisons for a while and some cashback from Lidl, on top of the reward points I get with my card which works out between 0.5% and 1% cashback depending on how you spend them. Would definitely recommend.

It looks like Amex have just added location maps to transactions as well which I know people here like. Although the store name and web address are incorrect…

Well I still get no offers. Amex won’t tell me why. I’ve never missed a payment or had any issues with them. Their customer service has declined in recent years. They have off-shored a lot of the call handling, and unless it’s a simple task, everything has to be sent via email to “Back office” to fix and you can’t talk to anyone who actually can help.

Gone with a Tesco Bank card beacuse I can use the points to buy petrol or beer. (2 most important things for a 18 year old)

Overseas I would use my debit card, I only want this for section 75 or for a unexpected pruchase so it will be kept at the back of my wallet just in case.

Checked very few places in my area take it, only Tesco, Morrisons, Asda and 1 Indian resteruant. (Rural area so alot of my spending is at independent shops that only take visa/mastercard so I factored this into my decision.)

Yes tesco bank have meh service but I had a very small chance of getting the Amex Everyday cashback so it’s a good mix of rewards.

£250 limit but i’ve opted for them to ask me before increasing it. (will decide at the time, will most likley decline)

Direct debit from monzo setup to pay in full.

Has anybody here switched the card they have relatively early in their membership?

I’ve had the Rewards Card for 6 months and I’ve been pretty impressed with it and I’ve been able to put quite a bit more spending through it than I initially thought I could thanks to IFTTT and Monzo.

Anyway after reviewing my spending and my needs I’d like to switch to the Gold Card. I’d rather just have Amex switch my card and account rather than filing a new application. From what I can see online it’s possible to do it but I’ve also found a few sites claiming that you need to have held an account for more than a year to be able to switch, that said all of these seem to be US focused with the 1 year rule being due to a law there.

I’ll of course give them a call on my lunch break tomorrow to find out but if anybody here has experience of doing this you may just save me a customer services call!

Having a credit limit this low will significantly harm your risk scoring over time. If there’s any offer for a limit increase you’d be best off taking it.

I haven’t had any Amex offers for a good few months, not sure why - I used to get loads

Their customer service was good on the only time I’ve had to call them though - when they reduced my credit by more than a third for seemingly no reason. It was restored back to the previous value on the call (I’d paid my statement in full every month and had never missed a payment, so I’ve no idea why they reduced the limit by so much).

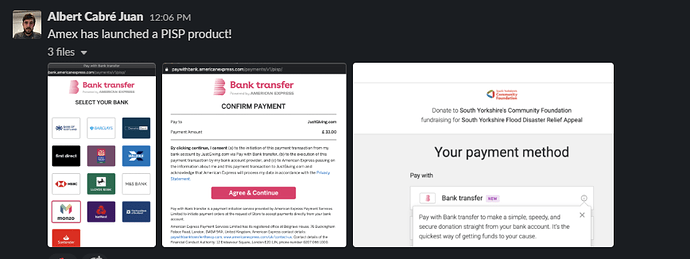

From the Open Banking Slack - Looks pretty cool

https://www.americanexpress.com/content/amex/uk/merchant/pay-with-bank-transfer.html

Just applied to the platinum cashback. What kind of credit limits do people have?

Is there a public link to this slack?