Well it wouldn’t be the same would it if Monzo did actually “compete” and offered the best deals than other banks. Half the people on this community don’t even use Monzo as their daily banking needs and use other banks so clearly they ain’t capturing people’s needs.

They’re capturing 13 million people’s needs.

They don’t need to compete, they need to be different and stand out.

I wouldn’t switch to monzo because one of my bills <£150 would be paid, that would daft.

They do most things other banks do not in terms of social payments, bills and spending management, app design and functionality.

There’s very little comparison, removing faster payments, a debit card and direct debit support.

No. A bank is offering a payment of up to £150 for people who pay actual bills from their (paid) Personal or Joint accounts on a random basis.

It’s quite simply marketing, to get more people to enrol in a paid plan. Another positive to help Monzo boost paid plan subscribers. Like the 1p challenge that offers £100 a month to random people in the challenge, with a large possible final payment to one person who has completed the challenge in full. The odds are against it for almost all, but when you look at it, it’s not gambling. It’s savings.

Same here. Maybe not savings like the 1p challenge, but less spendings (if you’re lucky to get a Billsback™️’gift’)

The key difference between switching incentives vs Billsback is that this appears to be, at least at face value, a “simple lottery” as you have to be on a paid plan to qualify for Billsback. The definition of a simple lottery is at Types of lotteries and their regulations and it certainly seems to qualify although I’m far from a legal expert in such matters. I’m assuming the 1p savings challenge is similar as Monzo describes this as a prize draw on Monzo 1p Saving Challenge Pot Prize Draw Rules but this seems to have more detailed T&Cs with regards to valid awards etc.

Neither am I.

But way too much conjecture is being injected into this paid-for-offering.

Not sure why Billsback has to be on the Home tab under Rewards; I’ll almost certainly never click on it again and it would be better in the Extra/Perks/Max tab.

I’d have never noticed it if it wasn’t under the Rewards section as I never go in the Max tab except for my Greggs every week which is put at the top.

Hey, if I’m understanding this right, does it matter where the bills paid from, like your current account, a joint account, or even a pot, as long as it’s connected to Monzo? I bet a lot of us are wondering about that, huh? I couldn’t find anything about it in the terms.

Joint account bills

Bills paid from a joint account will be eligible for Billsback, as long as at least one of the account holders has an active Monzo Extra, Perks, Max or Max + family plan, and neither has opted out of Billsback.

Tap Billsback on the Home Screen, then scroll down to terms, bottom option.

To add, bills don’t get paid from Pots directly, the money is moved from Pot to main account when the bill is taken from the account to cover it.

Personal and joint accounts are covered, including personal and joint debit cards taking into consideration a paid subscription being required for either party.

According to the T&Cs, the monthly Monzo fee counts as a bill.

So there’s 1 million+ “bills” just there.

And I’m sure Monzo would rather pay back £3 than £150

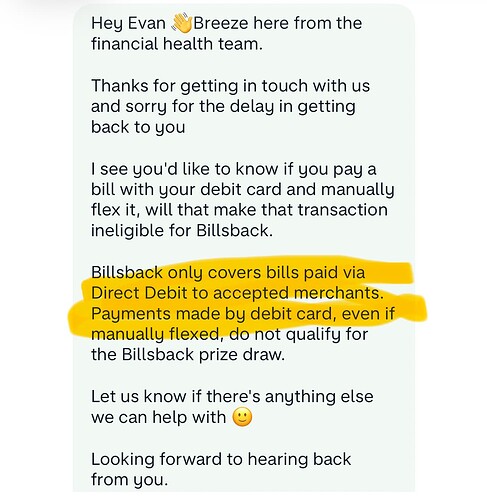

Whilst the T&Cs say Flex transactions don’t count, obviously payments made with a Flex card won’t count, but if I pay with the debit card and manually flex it, will that also invalidate that transaction from Billsback?

I very much doubt it’s a “pick the cheapest” it’ll just be randomised with a maximum amount at £150.

Flex card purchases are not covered. Debit card purchases are.

When you pay by debit card and flex it later, the transaction is still made by debit card thus counts as a bill, though needs to be one of the merchants as noted in the terms.

This is true, however the odds of a higher value being randomly selected are increased by a significant number of low value fee charges.

Which is fair, but to be fair to Monzo I don’t think particular feature is meant to incentivise people to upgrade, but rather aims to incentivise people to pay more of their bills from their Monzo account(s).

Here’s some misinformation from the in-app chat. They are claiming it is only direct debit transactions that are eligible.

Chat are not correct.

Refer to the terms and conditions as noted above.

Oh I’ve already told them they are wrong. I sent them the original question at around 7am. They’ve only just gotten around to replying.

Disappointing that whatever training they received hasn’t been noted too well.

Interesting Skype is on the list, I thought Microsoft had closed them down.

1Password is there but Bitwarden isn’t.

Back blaze is there but other hosting providers such as Mythic Beasts aren’t.

1pmobile is missing whilst other mobile operators are there.

1p and Mozillion need adding.