Arro Money, quite a similar proposition to Viola Black, has just launched its first Crowdfunding raise on Crowdcube.

Fees look…interesting.

Arro Money, quite a similar proposition to Viola Black, has just launched its first Crowdfunding raise on Crowdcube.

Fees look…interesting.

Seem to be targeting a market of people who don’t have access to banks but then want you to pay a monthly fee? Seems a little conflictory to me.

Sooo not backing the Crowdfunding then?

My opinion? If I had a few hundred quid spare, I’d burn it on the front lawn. At least I’d get warm.

Ooh, mini KLF party

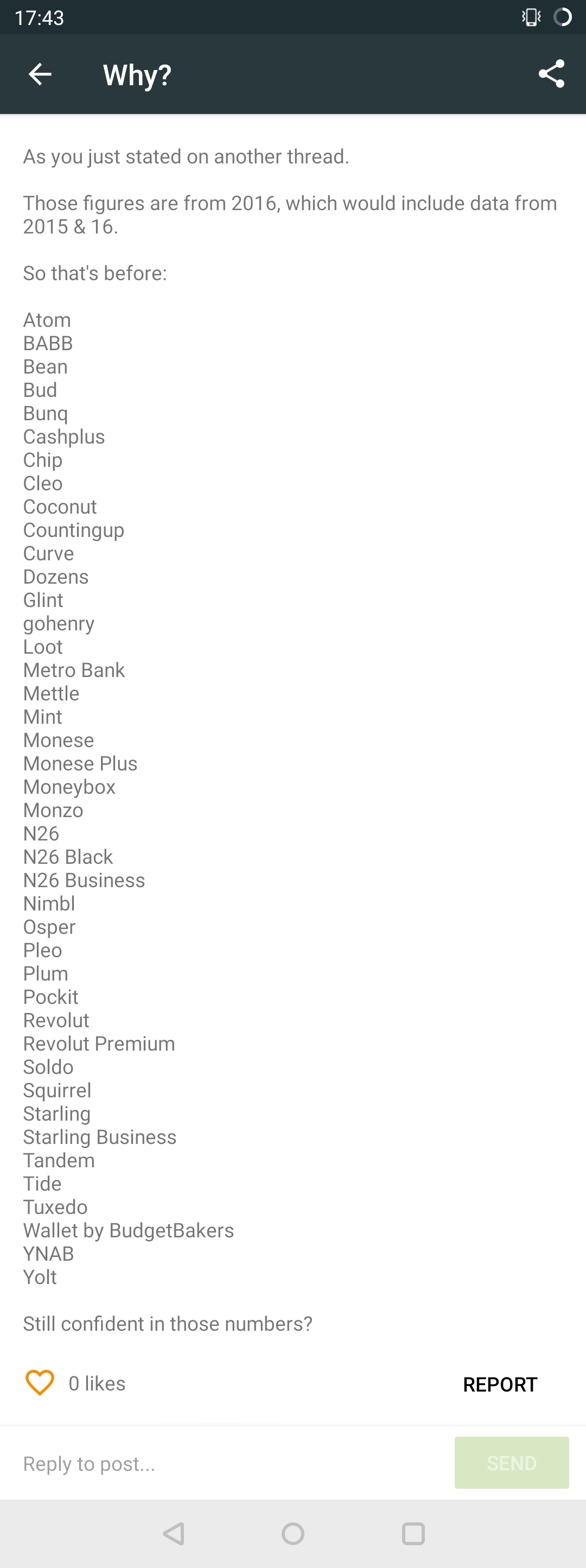

Be quicker to list the people who have no intention of creating a product offering a current account

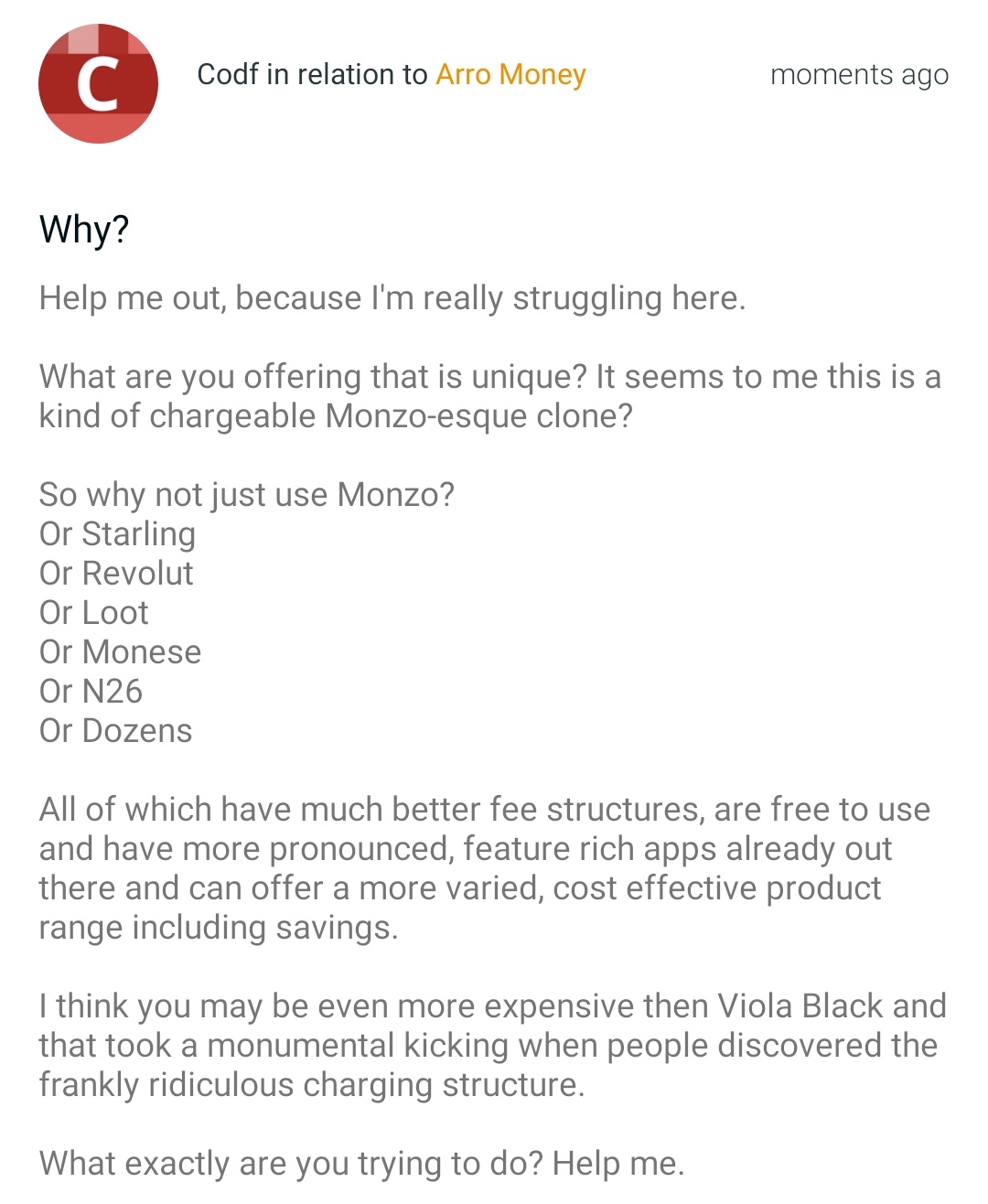

Wonder if I’ll get a reply.

My favourite part of that post is “help me”

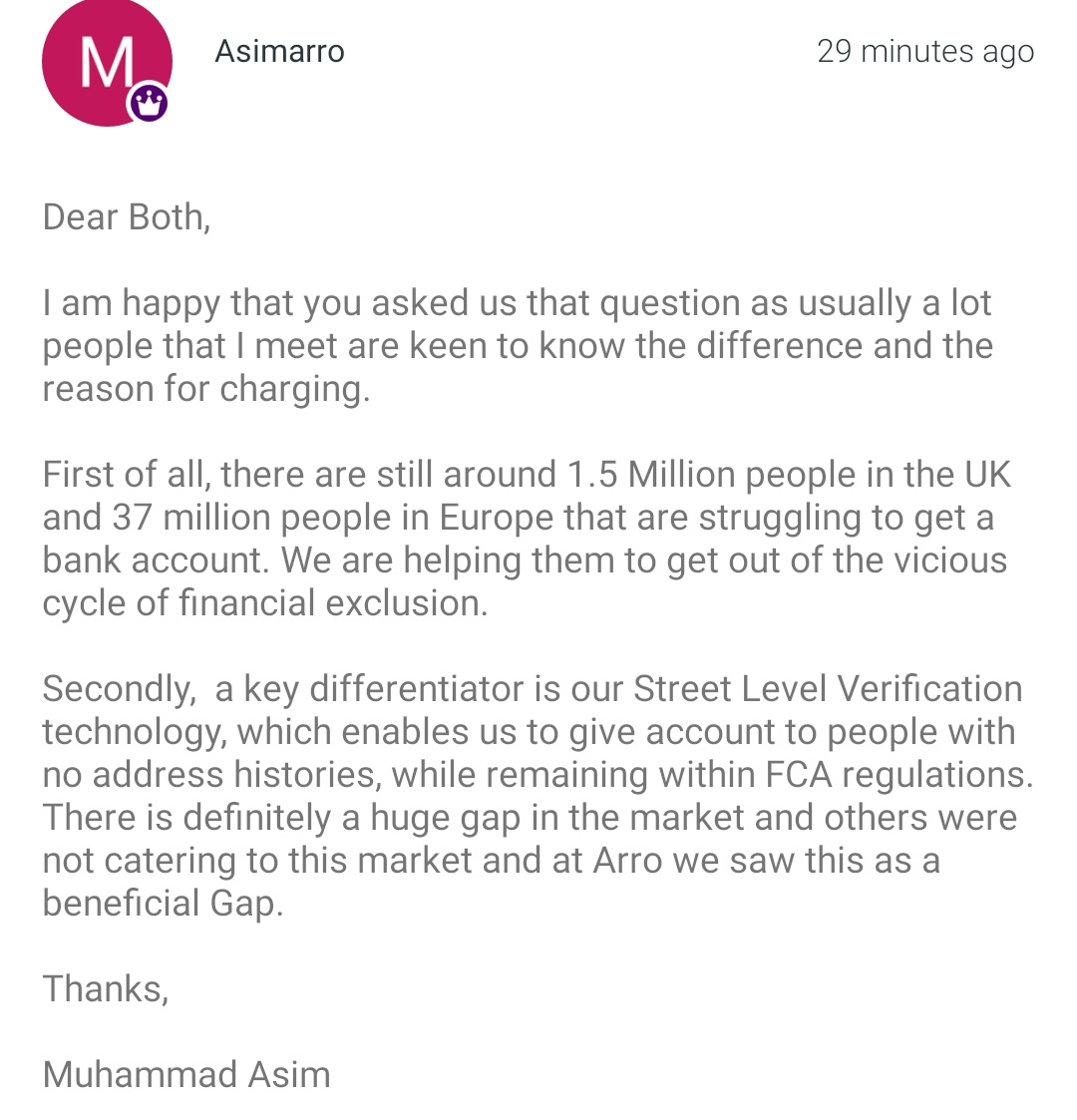

So they responded. Quoting some fairly outrageous figures which I assume where picked out of the 2017 FCA report - the latest but imo still disingenuous to quote when considering the rise of Monzo et al.

They think they will generate revenues of £500+ per customer, which is frankly ludicrous. Their target market is unbanked individuals which includes, but not limited to bankrupt individuals and low income, paid cash workers (which they’re going to charge to deposit).

On another thread I noticed they do not need any proof of address or address history, so how they are circumventing ‘Know Your Customer’ is beyond me. Not to mention going to be able to combat fraud effectively. Maybe @cookywook or @HughWells are able to offer a little insight or some thoughts on how they’d do this?

Frankly, I don’t think I could ever touch this as an investment proposition.

Thoughts?

Financial inclusion yet they are charging fees… Surely Monzo does a lot more financially inclusive practices

Indeed.

It turns out there figures come from the 2016 FCA report.

I honestly…nope they’re worse then Viola Black, at least their CEO is wasting his own money.

I just can’t believe that they would use FCA stats to justify asking people for money

I’ll stop flogging the horse now. It’s dead.

2016?!

I spotted this today. I wondered if anyone was talking about it over here. The whole pitch is bizarre. For starters, they claim to target people who are unbanked. But they don’t support cash deposits yet, so how will unbanked people get any money into the account?

It’s completely bonkers.

I challenged them in the comments about the figures and they sent me a document from 2015/2016.

I was beyond bewildered.

I’m done. I think i’m FinTeched out. Won’t be signing up or investing in this one

It finally broke me

I always wondered how there’s enough of a market just for Uaccount, let alone any clones.

The only explanation is surely that it’s far easier to get verified, but then the fraud must be horrendous…

The market is really flooded atm and not that many apps offer different features.

These unbanked people with no address history, do they have smartphones and the ability to pay the account fees?

We have a lot of people in our office who come from other countries and this is their first UK job. They mostly sign up with Revolut because it makes it really easy to tranfer their foreign money into a UK account.